lush tropical paradises

Australia's diverse landscapes have given rise to some of the most stunning gardens in the world.

Contact To Schedule Your Free Consultation

The Royal Botanic Garden, Sydney

The Royal Botanic Garden in Sydney is a horticultural marvel that spans 30 hectares. Located right on the shores of Sydney Harbour, it offers breathtaking views of the Opera House and the Harbour Bridge. The garden features a remarkable collection of native and exotic plants, making it a must-visit for any garden lover.

Melbourne Royal Botanic Gardens

Situated in the heart of Melbourne, these gardens are renowned for their stunning landscapes and diverse plant collections. The Guilfoyle's Volcano, a striking water reservoir garden, and the tranquil Fern Gully are just a few of the highlights here.

National Botanic Gardens, Canberra

Nestled at the base of Black Mountain, these gardens are dedicated to the preservation of Australia's unique flora. Visitors can explore themed gardens, including the Eucalyptus Lawn and Rainforest Gully, showcasing the country's natural beauty.

Adelaide Botanic Garden

Founded in 1857, the Adelaide Botanic Garden is a lush oasis in the heart of the city. The internationally acclaimed Bicentennial Conservatory, home to tropical rainforest plants, is a major attraction here.

Brisbane City Botanic Gardens

These historic gardens along the Brisbane River offer a serene escape from the bustling city. Wander through the Weeping Fig Avenue, and you'll feel transported to another world. The gardens are perfect for picnics and leisurely strolls.

Hunter Valley Gardens

Nestled in the beautiful Hunter Valley, this garden boasts over 25 hectares of meticulously designed landscapes. Visitors can explore themed gardens, including the Italian Grotto and the Storybook Garden.

Yellow Flowers: A Comprehensive Guide to Varieties and Meanings

Top Companion Plants to Pair with Your Happy Plant for Enhanced Beauty

The Urban Jungle: A Guide to Tree Removal in Sydney’s Inner West

Stump Grinding 101: A Comprehensive Overview of the Essential Tree Removal Technique

Preserving the North Shore Landscape: Responsible Tree Removal Practices

Navigating the Seasons: A Year-Round Approach to Effective Tree Pruning

Expressing Friendship and Joy with Yellow Flowers

Express Your Love: Why Choose Our Flower Delivery Services in Central Coast

Decoding the Popularity of the Happy Plant Among Plant Lovers

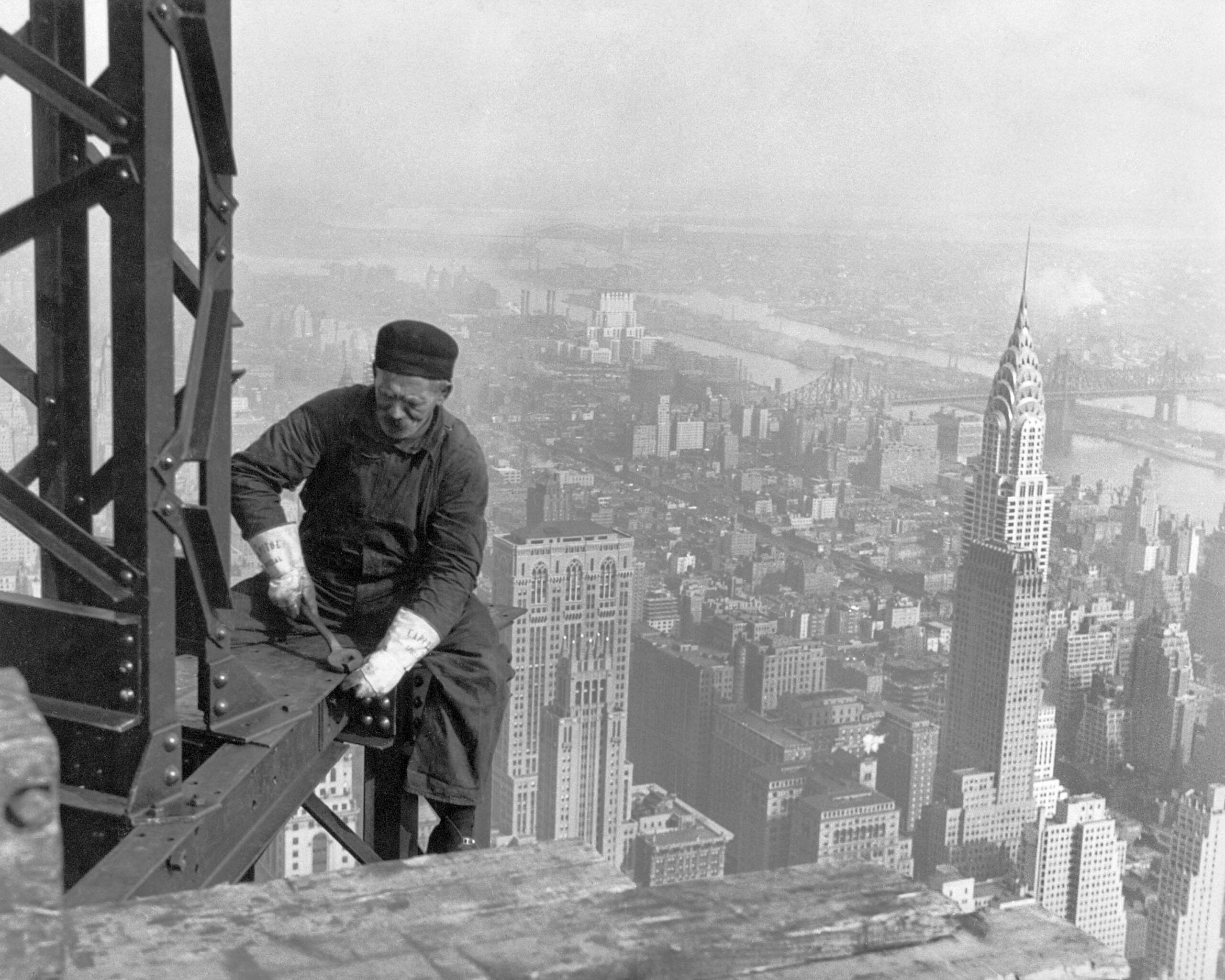

25 amazing photos of the construction of the Empire State Building

Get Involved

We encourage you to join our growing community at lushflowerco.com.au and be a part of the "Art Of The Garden" journey.

Share your garden stories, photographs, and insights with us, and let's collectively celebrate the beauty of Australia's gardens.